Over 30% of adults have already fallen victim to bank or credit fraud in the US. Europe faces a massive €1.8 billion loss annually due to fraud while India has seen a shocking 166% surge in bank frauds. As these stats prove, bolstering security in the BFSI sector is becoming more complex but crucial. And AI could be the game-changer here in fraud prevention.

From real-time anomaly detection to automated reporting, AI and machine learning can identify and preven fraud more swiftly than traditional methods.

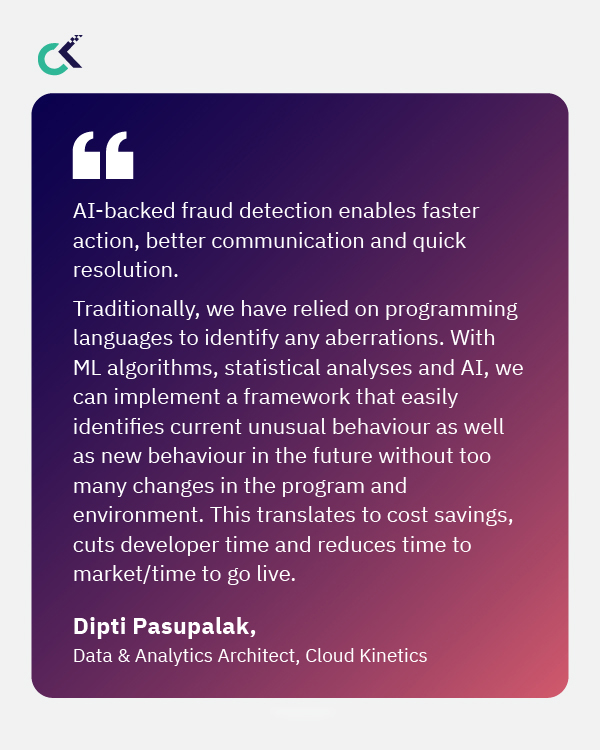

With insights from BFSI industry expert Dipti Pasupalak, Data & Analytics Architect at Cloud Kinetics, we explore how leveraging AI-backed systems not only speeds up detection and reduces manual reviews, but also adapts to new threats as they emerge.

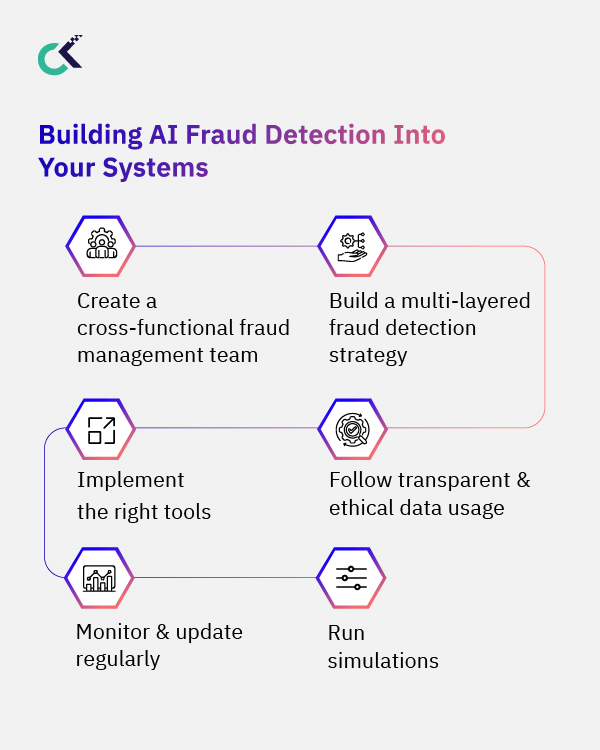

See use cases, benefits and a roadmap for building an effective fraud detection strategy, and equip yourself with the insights needed to stay ahead of fraudsters