When it comes to running banking and finance operations, fraud is a top concern and rightly so.

- Fraudulent transactions across Europe are an estimated €1.8 billion per annum.

- The number of bank frauds in India was up 166% in FY24.

- In the United States 26% of adults surveyed said they had personally experienced bank/credit fraud.

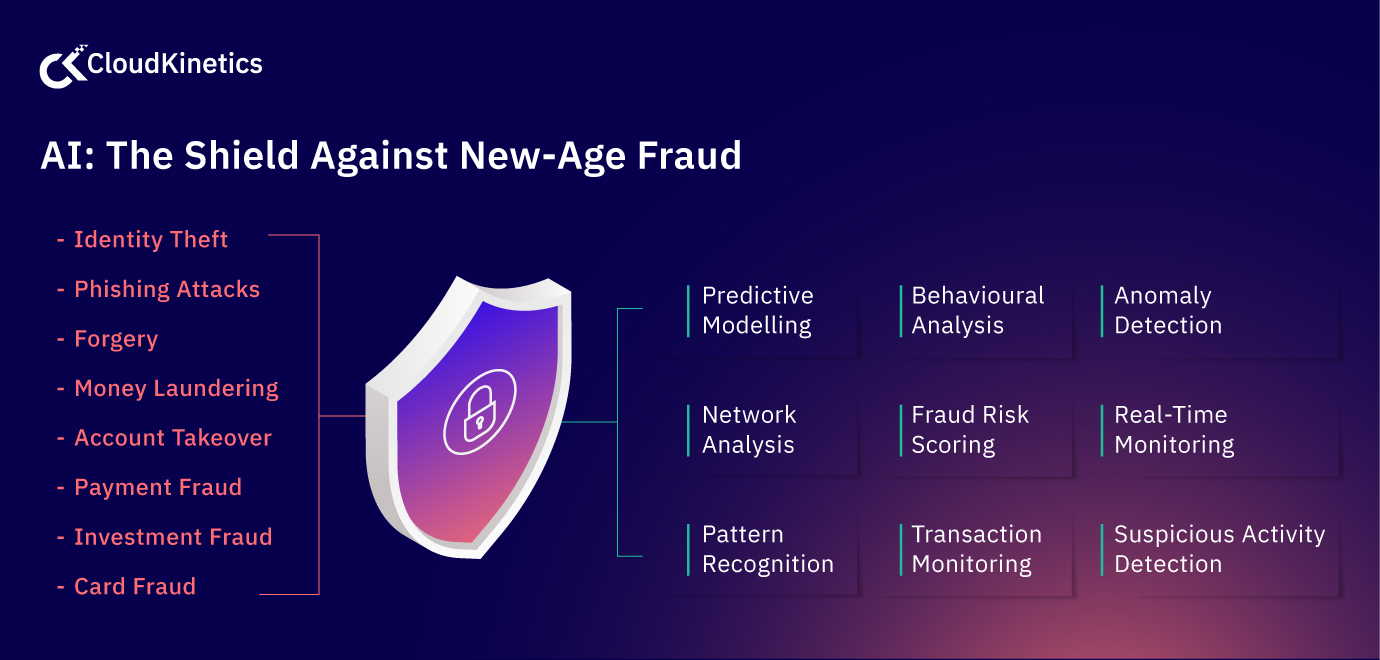

The explosion of online banking, neobanks, fintechs and financial applications has also made it easier for scammers to strike, making it vital to spot anomalies in transactions and strange behaviour to catch fraud early. In this scenario, Artificial intelligence (AI), Generative AI & Machine Learning (ML) are new sentinels for safe and secure business operations and technology, helping banks, financial services, and insurance (BFSI) companies stay one step ahead of fraudsters.

According to one survey, 62% of UK and US based large/mid-sized businesses intend to deploy AI-based solutions to combat the issue.

Power of AI in fraud detection: Traditional security options vs AI-driven solutions

- AI can “learn” from past fraud cases, helping ML algorithms more accurate with time. An AI model flags suspicious data/anomalies in transactional and behavioural data.

- As self-learning models, AI gets smarter over time, reducing the likelihood of repetitive errors and minimizing false positives.

- AI can not only alert the humans overseeing the systems to potential fraud, but also take action by blocking transactions or removing suspicious attached files.

AI and ML can give banks and financial companies a huge advantage with a “two-steps ahead” approach to security and risk management. For instance, for a large multinational bank, fraud detection traditionally involved wading through mountains of data, reading endless reports, and manually checking every suspicious transaction. It was a slow and painful process, often leading to delays in spotting fraud. Sometimes, customers would even have to report the problem themselves, which could mean losing a lot of money before the bank could fix the issue.

The power of AI-backed fraud prevention means that the same bank can now process copious volumes of data in real time, monitor all activity including transactions as they happen. When a possible high risk event begins to occur, it escalates this to the top of the list for review on priority. The bank can now intervene as the fraud is occurring and prevent it from happening or reduce further potential loss. Overall, this can mean better customer satisfaction with fewer losses incurred.

Using AI in fraud detection means fast detection – since AI algorithms act instantly to freeze/block a transaction/account, and offers increased accuracy over traditional methods – since AI applies dynamic rule setting, learning from itself, rather than just predefined rules. Over time, this results in cost optimization as the long-term cost of prevention vs reaction is lower.

Business impact of AI for fraud prevention

AI can be applied in multiple ways to help mitigate the risk of fraud:

- AI-driven analytics platforms can integrate diverse data sources (financial data, market data, customer data) to provide a comprehensive view of risk exposure.

- GenAI for real-time fraud detection identifies suspicious patterns of behaviour through comprehensive data analysis; this helps block and prevent potentially fraudulent activity.

- AI-powered alert prioritization is used to classify alerts by risk level, ensuring that higher risk cases get assigned for review and intervention first, which means speedy intervention and protection for the business.

- Predictive analytics help determine future risk based on constantly updated data. AI & ML can minimize false positives, making for a seamless customer experience while ensuring security.

- Data-driven operations backed by AI/ML and robust analytics help ensure regulatory compliance and support KYC verification.

- Automation along with a strong GenAI/AI/ML powered business analytics and data engine supports scalability and boosts operational efficiency.

Use Cases for BFSI | How AI helps in fraud prevention

AI-based use cases for fraud prevention in the banking and financial services sectors can take on various forms:

1. Real-Time Anomaly Detection: Systems using GenAI can detect fraud early by learning normal behaviour and spotting unusual activity or deviations that might indicate account takeovers from identity theft or phishing. This improves speed – something that’s crucial when dealing with fraud, where every minute counts.

GenAI-powered behavioural analysis can monitor app usage, banking transactions, payments, or any other financial transaction across channels/touchpoints in real time and flag off potential threats like unusual spending pattern/unauthorized account access, blocking them and preventing fraud.

AI-backed fraud detection enables faster action, better communication and quick resolution. Traditionally, we have relied on programming languages to identify any aberrations. With ML algorithms, statistical analyses and AI, we can implement a framework that easily identifies the current unusual behaviour as well as new behaviour in the future without too many changes in the program and environment. This translates to cost savings, cuts developer time and reduces time to market/time to go live.

Dipti Pasupalak, Data & Analytics Architect, Cloud Kinetics

2. Automated Fraud Reporting and Reduced Manual Reviews: AI and ML allows for automated fraud reporting and reduces the need for manual reviews. GenAI generates suspicious activity reports (SARs) incorporating millions of data points. With a lower burden on analysts, finance and IT teams, their time can be freed up to be used to propel business growth, enhance solutions and drive innovation.

Automation also makes the process of identifying investment fraud, payment fraud, or card fraud faster, more efficient and often more accurate, with lower instances of false positives.

3. Enhanced Authentication with AI: Secure authentication powered by AI can be improved with GenAI and reduce risk in case of forgery or identity theft.

GenAI can help refine algorithms used for recognition and verification, thereby making traditional biometric verification methods more effective and limiting access to only legitimate users. This cuts the risk of unauthorized access/ account takeover fraud.

Use Case | Seamless User onboarding & authentication with AI/ML-powered solutions from AWS: In the online registration process for an account, using ML-powered facial biometrics – with pre-trained facial recognition and embedded analysis capabilities, ID verification, user onboarding and authentication – can be done securely with no need for prior ML expertise in-house.

4. Detecting Variations in Usage Patterns: AI is able to analyse metadata to detect variations from the norm that might be missed in manual reviews by the human eye. As fraudsters begin to use sophisticated methods including AI to commit fraud, the use of AI as a defense against things like deepfakes will be critical.

Take for example a scenario where a customer has been duped into sharing their net banking details with a fraudster. Normally transactions after this would not be flagged since the data compromise has not occurred on the bank’s system. But AI-based risk monitoring software will spot any unusual pattern in the transactions or amounts not in line with their normal transactions, or even things like screen resolution, currency or language used and flag it for manual tele-verification in real time, more swiftly than older methods.

Use Case | Fraud prevention with Snowflake’s scalable multi-cluster shared data architecture and advanced data governance: This can help protect merchants from fraud and risk. Snowflake-powered fraud prevention models are able to identify bad actors, detect attack vectors and block account takeover attempts.

5. Offline Fraud Prevention: AI-powered video analytics can flag off suspicious behaviour at ATMs and branches that may be linked to ATM skimming, usage of stolen cards or cheque forgery.

Use Case | Geospatial analytics and AI for fraud detection from Databricks: Geospatial data, machine learning and a lakehouse architecture from Databricks help FSI clients better understand customer spending behaviours and spot abnormal credit card transaction patterns in real time. This enhances the fraud prevention and detection capabilities of the organization, which in turn reduces losses and helps cement customer trust.

Building an AI-backed fraud detection strategy

Banks and financial institutions aren’t the only ones with an eye on AI. According to Deloitte’s Center for Financial Services, fraud losses in the United States could hit US$40 billion by 2027, on the back of GenAI.

With fraudsters already using AI, industry needs to quickly adopt an AI-backed defense as well. Here’s your roadmap:

- Create a cross-functional fraud management team: Drawn from IT, operations, compliance, legal, data sciences

- Build a multi-layered fraud detection strategy: Use AI in tandem with traditional anomaly detection systems, encryption, multi-factor authentication etc.

- Implement the right environment and tools: These must be compatible with existing infrastructure and scalable and effective. Banks must modernize their infrastructure to effectively leverage AI for fraud prevention.

By migrating to the cloud or adopting a hybrid approach and establishing a robust data platform, banks can ensure timely access to high-quality data. This real-time data empowers AI, ML, and generative AI systems to analyze patterns, identify potential fraud, and enable rapid intervention.

- Follow transparent & ethical data usage: Adhere to customer privacy norms and practise ethical data usage

- Monitor & update regularly: Retrain with new data to stay effective against new types of fraud

- Run simulations: Run controlled realistic fraud attack simulations to check robustness of the systems in place and keep ahead of advanced fraud attacks

Building an effective AI-backed fraud detection strategy into your organization requires an overall commitment to a security-conscious culture. In addition to the AI, ensure every “human firewall” is well armed to respond to fraudulent activity with regular training and a culture that encourages a security-first approach. Dipti Pasupalak, Data & Analytics Architect, Cloud Kinetics