Digital transformation is fueling the next wave of innovation in banking with initiatives such as digital lending, digital currencies and peer-to-peer payments. Leading the charge are neobanks and fintechs, disrupting the traditional landscape with a more open, marketplace-oriented approach to products and services.

For traditional banks this doubles up as an opportunity and an urgent reminder. To compete effectively with digital banks and fintechs and thrive in this evolving financial ecosystem, senior IT/business decision-makers at established banks must prioritize modernizing legacy systems and embracing the Open Banking paradigm.

Advancing customer experience with open banking

Open banking ushers in a new era of convenience and financial control. It fosters financial inclusion, more personalized services and convenience for customers. Open banking also increases the competitiveness of banks by enabling them to provide a diverse suite of financial products & services at reduced operational costs.

Some open banking use cases include:

- Instant payments and fund transfers directly from third-party applications such as PayNow in Singapore and Unified Payments Interface (UPI) in India.

- Account aggregation features for customers to access and manage savings & deposit accounts, loans, credit cards and investments from a single application.

From monolith to microservices: The application modernization journey to open banking

For most banks, successful adoption of open-banking standards will mean substantial re-architecting of their current application estate and IT infrastructure, and accelerated integration with third parties to on-board new products & services from partners. This is a critical success factor in the open banking ecosystem.

To seamlessly integrate with various third parties through APIs, banks will require an enterprise-wide adoption of microservices and API-based architecture to consume data from core banking and other legacy backend systems. This will support agile delivery, provide scalability and flexibility with multi-cloud / hybrid cloud deployments.

A microservices-based application modernization approach will eventually enable banks to drive growth through new business models, collaborate with partners to quickly on-board new product offerings and enhance customer experience.

1. Building the optimal microservices-based architecture for open banking

The application modernization journey and timelines will depend on the product roadmap, technology readiness and current IT architecture of the bank.

Banks with monolithic applications, legacy core banking systems and legacy integration platforms will need to adopt a phased approach to minimize business risks and potential disruptions. A phased approach will also allow banks to on-board partners and build marketplace offerings like digital wallets, lending and insurance services for customers in an incremental manner.

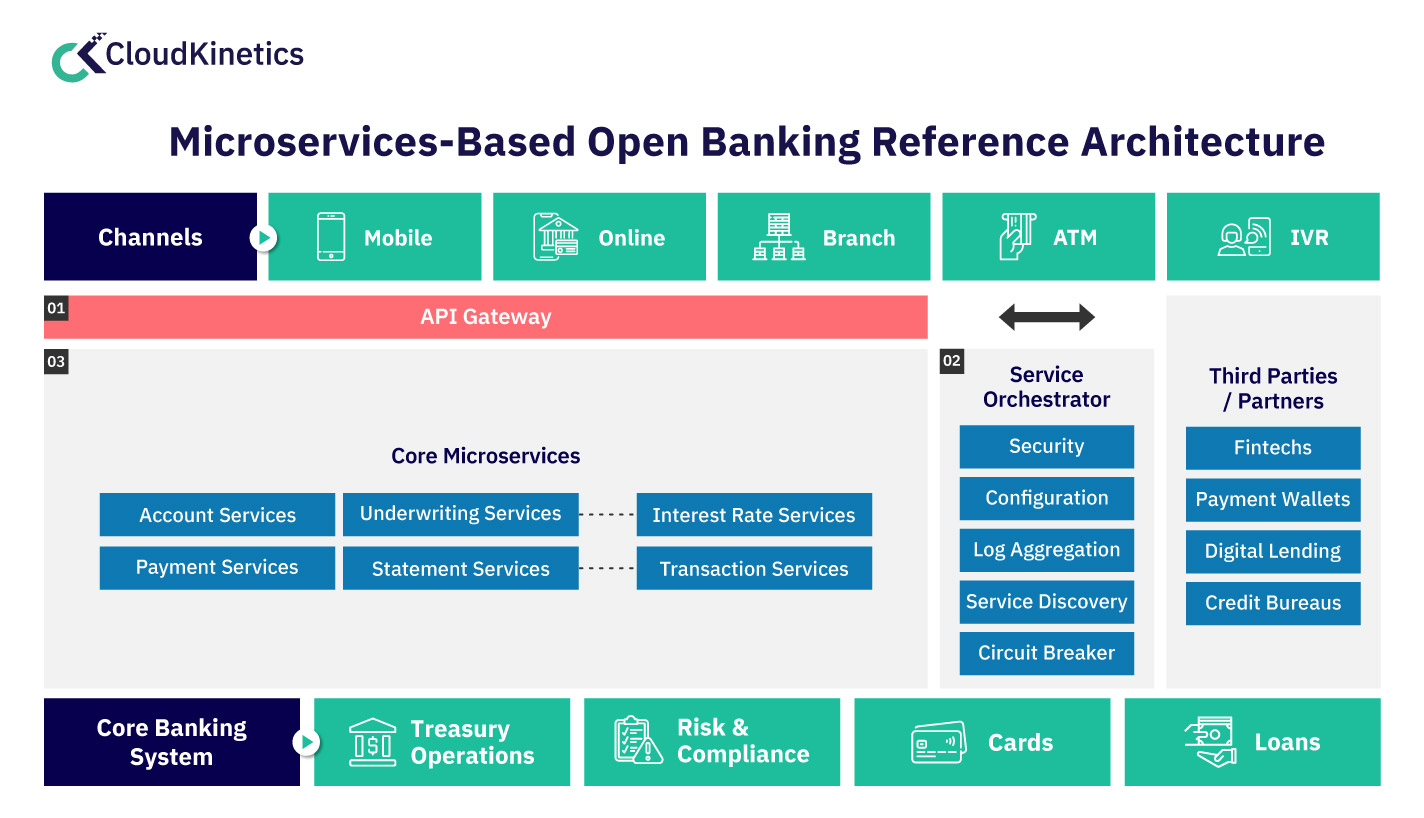

The figure here below illustrates an indicative microservices-based reference architecture for a bank along with key components such as API gateway, service orchestrator and microservices-based core services.

- The first step in the application modernization journey would involve building a service orchestration layer (Figure 1, point# 2) to efficiently manage commonly used cross-cutting concerns and non-functional requirements such as security, configurations, log aggregation, distributed tracing, service discovery and circuit breaker.

- All the above services can be developed as common components designed to ensure the core business logic is separated from cross-cutting non-functional concerns.

- The service orchestration layer along with an API gateway will interface with the core banking platform and expose APIs to both internal and external parties for accelerated integration.

- In subsequent phases, banks can start decomposing their monolithic core applications using various Microservices design patterns such as Strangler and Sidecar aligned to product domains such as account services, payment services and underwriting services (Figure 1: point# 3). For example, account services would include features such as account opening, customer onboarding and account updates.

2. Microservices-based application modernization: Challenges & way forward

Transitioning from a monolith to microservices can be a complex but rewarding undertaking for banks. Often, banks are concerned about technical complexity, security challenges and change management.

The right application enablement partner will equip you with a comprehensive roadmap, from initial strategy and architecture design to seamless implementation and ongoing support, ensuring your microservices journey is smooth and efficient.

3. Modernizing banking applications with Cloud Kinetics

Cloud Kinetics helps banking & financial services customers to amplify the value of cloud with our Application Modernization approach, driving business agility & flexibility.

Our modernization competencies focus on Application Portfolio Assessment, Microservices Architecture, Serverless, API Integration, Security & Compliance combined with DevOps & Continuous Delivery Approach. Our strategic partnerships with industry leaders like AWS, Azure, GCP (hyperscalers), Kong (API gateway), CAST (portfolio assessment) enable us to deliver a seamless solution for our customers.

Customer impact story: App modernization, cloud-native design & a one-stop digital marketplace for a leading fintech

Our customer is a leading fintech company that facilitates financing through credit guarantee schemes for micro, small & medium enterprises (MSMEs). They felt their current platform was lacking the comprehensiveness, accessibility and user-friendly experience that MSMEs now demand in a digital-first world.

With Cloud Kinetics, the customer embarked on a transformation journey to modernize their platform and provide MSMEs with a one-stop digital marketplace, with opportunities for cross- and up-selling products and services.

Cloud Kinetics developed the digital lending platform on AWS, using microservices architecture to create a cloud-native lending platform that was secure, scalable and adaptable to evolving needs. Cloud Kinetics also built a digital marketplace for the customer that expanded beyond loans, offering MSMEs financial products like working capital solutions, insurance options, and seamless integration with credit guarantee schemes. The interface enabled the bank to offer MSMEs a more intuitive experience and better manage their financial health.